Train Everyone on the Issues That Matter

CBANC Education offers over 200+ live webinars a year, a catalogue of over 1,000 on-demand titles, and in-depth training courses from proven industry experts.

![[separator] Featured Live](

/static/skilljar-monorepo/statics/dist/img/transparent.d89746888da2.gif

)

[separator] Featured Live

This Month's Featured Live Webinars

FREE

[separator]

![[FREE] Elder Fraud: Prevention, Early Detection, & Timely Reporting](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/3irvhmw3rs9nj/promo-image.1708982130.jpg)

[FREE] Elder Fraud: Prevention, Early Detection, & Timely Reporting

(Rec: 3/26/24) Fraud investigators who recognize the red flags, can act decisively, report the crime and help prevent the exploitation of vulnerable customers.

FREE

1 Hour

On Demand

Fraud

Elderly Abuse

Elder Abuse

Verafin

![[FREE] Navigating Compliance Challenges in BaaS/Fintech Partnerships: Is Your Bank Prepared?](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/2ilrdq51zwyw/promo-image.1709604251.png)

[FREE] Navigating Compliance Challenges in BaaS/Fintech Partnerships: Is Your Bank Prepared?

(Rec: 3/29/24) Join us for an insightful webinar tailored for financial institutions grappling with the complexities of Banking as a Service (BaaS) and Fintech partnerships.

FREE

1 Hour

Compliance

Risk

Vendor Management

Elder Abuse

FinTech

Fintech

Regulatory

Live

![[FREE] Future Prep: Staying Ahead of Bank Audits](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/3gkv4fs0odgko/promo-image.1710524296.png)

[FREE] Future Prep: Staying Ahead of Bank Audits

(Live: 4/10/24) Join Integris' Cal Roberson and Eric Durbin as they talk about the future of audits and what you can do to prepare.

FREE

1 Hour

Audit

FFIEC

Technology

Sponsored

Live

Integris

![[FREE] Instant Payments: Scaling and Responding to New Fraud Risks](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/2xo4hq9yhak28/promo-image.1710521899.jpg)

[FREE] Instant Payments: Scaling and Responding to New Fraud Risks

(Live: 4/23/24) Join Product Experts Corey Lynch and Tony Fitzgerald for an overview of the evolving nature of payments fraud scams, understand the threat they pose to financial institutions, and hear why a complete solution is essential to stopping payments fraud in its tracks.

FREE

1 Hour

Payments

Fraud

Verafin

Sponsored

Live

![[separator] Featured On-Demand](

/static/skilljar-monorepo/statics/dist/img/transparent.d89746888da2.gif

)

[separator] Featured On-Demand

This Month's Featured On-Demand

FREE

[separator]

![[FREE] Cybersecurity Awareness Training: A Guide to Keep Employees and Customers Cyber-Aware](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/zl49uu3giy8j/promo-image.1700512713.jpeg)

[FREE] Cybersecurity Awareness Training: A Guide to Keep Employees and Customers Cyber-Aware

(Live: 12/14/23) Discover effective strategies and best practices for educating and empowering your workforce and customers to recognize and respond to cyber threats.

FREE

1 Hour

Information Technologies

Customers

Cybersecurity

Information Technology

Live

IT

Integris

![[FREE] Attracting and Retaining Millennials and Gen Zs in Credit Unions and Community Banks](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/36xl3ekkwtpfl/promo-image.1700086457.png)

[FREE] Attracting and Retaining Millennials and Gen Zs in Credit Unions and Community Banks

(Rec: 12/8/23) Join us for an exclusive webinar and brace yourself for a stimulating discussion that will unveil the strategies required for credit unions and community banks to attract and captivate the hearts of the younger generations in 2024.

FREE

1 Hour

On Demand

CRA

Community Banking

Friday Compliance Briefing: November 2023

(Rec: 11/17/23) If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. We will be offering a new Briefing once a month.

$15

30 Min

Regulation

Compliance

BSA

Briefing

Live

Lisa Zigo

![[FREE] Recognizing the Red Flags: The Rise in Stolen Check Fraud](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/pvvvjas7503v/promo-image.1698680277.jpg)

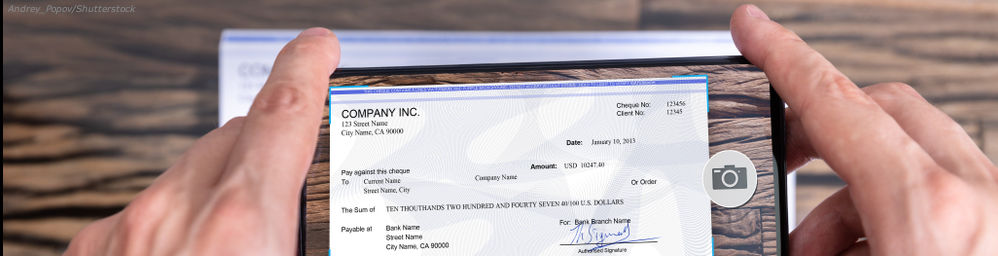

[FREE] Recognizing the Red Flags: The Rise in Stolen Check Fraud

(Rec: 11/13/23) Join Verafin for an informative presentation where our experts will discuss the latest red flags for stolen check schemes, how Verafin uses the power of consortium analytics to fight check fraud, and why seeing the full picture of fraud and understanding the risk associated with the deposit side of the transaction is essential.

FREE

1 Hour

Checks

FinCEN

Fraud

SAR

Live

![[FREE] 7 Ways to Protect Your Bank's Data](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/6s25kulkrgka/promo-image.1698864164.png)

[FREE] 7 Ways to Protect Your Bank's Data

(Rec: 11/9/23) The objective of this presentation is to make bankers aware of the seven CIS Controls that the FFIEC has adopted InTREx Exams and to educate them on what each Control is and why each Control is an important part of maintaining a safe and compliant IT environment.

FREE

1 Hour

On Demand

Cybersecurity

FFIEC

IT

CIS Controls

Results Technology

![[separator] Popular Cannabis Webinars](

/static/skilljar-monorepo/statics/dist/img/transparent.d89746888da2.gif

)

[separator] Popular Cannabis Webinars

Explore top Cannabis courses

FREE

[separator]

CRB Coffee Break - 4th Quarter 2023

(Rec: 11/17/23) Each quarter, we will provide the network an update on the status of cannabis-related banking issues. From marijuana legalization initiatives, marijuana-related banking issues, cannabis banking opportunities, and how financial institutions are addressing these issues, this will be your one-stop shop to stay up to date on the latest developments.

$99

1 Hour

Cannabis

Cannabis Related Business (CRB)

Coffee Break

Live

Becky Postar

CRB Coffee Break - 3rd Quarter 2023

(Rec: 8/18/23) Each quarter, we will provide the network an update on the status of cannabis-related banking issues. From marijuana legalization initiatives, marijuana-related banking issues, cannabis banking opportunities, and how financial institutions are addressing these issues, this will be your one-stop shop to stay up to date on the latest developments.

$99

1 Hour

On Demand

CCBP

Cannabis

Regulation

Compliance

Cannabis Banking

Coffee Break

CBD Banking Regulations

Becky Postar

Cannabis Banking for the Board

In this webinar, we cover legalization, legislation and expectations for your Cannabis Banking Program. Your Board can tune in to get their training or you can use this session to get the materials and knowledge necessary to provide the training internally. (Rec. 7/9/21)

$179

1 Hour

On Demand

Cannabis

Certified Cannabis Banking Professional (CCBP)

Marijuana Related Business

Banking

Banking the Cannabis Industry

Cannabis Related Business (CRB)

Board of Directors

Safely and Successfully Banking Cannabis

Join Becky Postar in an overview of Cannabis Banking! This webinar will cover SAFE Banking updates, Hemp, CBD and Delta-8 regulations, Cannabis Lending and more!

$179

1 Hour

On Demand

Cannabis

Regulation

Certified Cannabis Banking Professional (CCBP)

Marijuana Related Business

Basics

Updates

Banking Cannabis

Hemp

Delta-8

Banking

Cannabis Related Business (CRB)

Changes to the Cannabis Banking Industry and Expectations for 2022

It is time to reflect and discuss the current state of cannabis banking and gaze into our crystal ball to see what lies ahead for the industry in 2022. (Rec. 10/15/21)

$179

1 Hour

On Demand

Cannabis

Regulation

Marijuana Related Business

Compliance

Banking

Cannabis Related Business (CRB)

![[separator] Popular Trainings](

/static/skilljar-monorepo/statics/dist/img/transparent.d89746888da2.gif

)

[separator] Popular Trainings

Our recommended training courses

FREE

[separator]

Training - Vendor Management Series v.2.0

A five part series on Vendor Management from 10-D Security

$99

1 hr 20 min

Third-Party

Vendor Management

Training

Intermediate

Training - Board & Senior Management Series v.2.0

14 modules focused on Information Security Training from 10-D Security (Updated 4/18/23)

$99

Basics

Training

Board of Directors

Senior Management

Training - ODFI Workshop: ACH as an Originating Depository Institution and Corporate ACH Origination Basics

In this training you learn what the Originating Depository Financial Institution (ODFI) is and the significant number of warranties they carry when they offer ACH origination to their customers within the ACH network. These sessions will cover everything you need to know as an ODFI to protect your institution and Originators.

$399

5 Hours

ACH

Payments

Basics

ODFI

Training

Training - Certified Cannabis Banking Professional Certification Version 2

The updated version of the CBANC Certified Cannabis Banking Professional Certification

$1,995

12 hr 5 min

2022

CCBP

Cannabis

Certified Cannabis Banking Professional (CCBP)

Training

Angela Lucas

Audit and Risk for RDFI

This session focuses on the Nacha Operating Rules audit requirements and guidelines that are specific to Receiving Depository Financial Institutions (RDFIs).

$179

1.5 Hours

On Demand

Audit

Risk

NACHA

ACH

RDFI

ACH Authorization Modernization: Be Prepared

It's time to prepare for minimum standards for all consumer debit authorizations, new Oral authorization standards and the introduction of a Standing authorization into the Rules. Even “Alexa” can now be part of an ACH authorization. (Rec. 8/23/21)

$179

1.5 Hours

On Demand

ACH

Advanced

Authorization

ACH Disputes and the New ACH Rules for Warranty Claims May 2021

Effective June 30, 2021 the Nacha Operating Rules will be limiting the length of time in which an RDFI will be permitted to make a claim against the ODFI's authorization warranty. This session will detail the Rules changes and outline best practices for consumer and corporate account holder claims. (Rec. 5/26/21)

$179

1.5 Hours

On Demand

ACH

Payments

Disputes

Error Resolution

ABCs of an ODFI

This 90-minute session provides a detailed overview of all of the information related to your obligations, rights, and responsibilities as an Originating Depository Financial Institution (ODFI).

$179

1.5 Hours

On Demand

NACHA

ACH

Payments

Basics

Authorization

ODFI

Critical Elements of an Effective CMS

We will discuss critical drivers of an effective, dynamic Compliance Management System, including policies and procedures, risk-based compliance monitoring and audits, and change management. (Rec. 5/5/22)

$179

1 Hour

On Demand

Regulation

Compliance

Audit

Risk

Procedures

Culture

Consumer Protections

CMS

Faster Payments 101 - including RTP & Fed Now

This session will help get you started by laying the groundwork for understanding the faster payments landscape and developing your strategy.

$179

1.5 Hours

NACHA

ACH

Payments

Real Time Payments

Procedures

Basics

![[FREE] Customer Engagement: What to Expect & How To Prepare for 2022](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/1reaqnfnc5jfn/promo-image.1668551067.jpg)

[FREE] Customer Engagement: What to Expect & How To Prepare for 2022

(Rec. 10/29/21)

FREE

1 Hour

On Demand

Customers

Leadership

Real-Time Payments: What Credit Unions Need to Know

Join Leslie Poole, a 25-year credit union industry veteran, payments technology innovator and Director/Treasurer of a $1.3 billion credit union as he guides a panel of experts on what "Real-Time Payments" are and how they work, technology considerations, safeguards for AML and fraud, and much more! (Rec. 4/22/22)

FREE

1 Hour

Free

On Demand

Compliance

Audit

Payments

Fraud

Credit

RTP

AML

FinTech

RTP® Risks, Rules, and Regulations: Fall Two Part Series

Faster payments are taking off in the electronic payments industry, and no product or service is buzzing more than RTP®, so it is time to build a foundational understanding of the different risks, rules, and regulations that surround RTP®. (Rec. 10/21/21 & 10/29/21)

$399

1 Hour

On Demand

RTP

Regulations

Rules

Risks

The 2023 Collaborative BSA School Day 1 Basics

CBANC Network and AML-ology are partnering again this year to offer the 2023 Collaborative BSA School. Join Nancy Lake, the Director of Training at ARC Risk and Compliance, as she uses her 16+ years of experience to walk you through the basics of BSA, and earn up to 6 CAMS and 6 CPE credits in day 1 of this q school. (Rec. 3/14/23)

$399

6 Hours

On Demand

Regulation

Compliance

BSA/AML

Basics

Fraud

School

BSA

Terrorist Financing

ACH for P2P Transfers: Perils and Protections

Don’t miss this chance to learn about the unique features of P2P transfers via the ACH. (Rec. 6/16/21)

$179

1.5 Hours

On Demand

ACH

Transfers

P2P

How to Write Right for Better Business Communication

In this session, learn how a few basic rules on grammar, punctuation, and usage can improve business written communications with clearer, more succinct content.

$179

1 Hour

On Demand

Business Writing

Basics

Writing

Destressing BSA Compliance

The Bank Secrecy Act has five pillars by which every institution must abide. Join Angelica Larrañaga, AAP, NCP, CAMS, as she demystifies and takes the anxiety out of BSA, AML, and CIP by explaining the five pillars of BSA; how AML and CIP fit in; and what all this means to your organization. (Rec. 4/21/22)

$179

1.5 Hours

On Demand

Compliance

Basics

Fraud

BSA

CIP

AML

Flood Rules: Demystifying the Tricky Spots

We will make sure you understand the flood rule basics: mandatory purchase requirements, notices, and force placing coverage. (Rec. 6/17/21)

$99

1.5 Hours

On Demand

Advanced

Rules

Demystifying

Flood

![[FREE] When to Consider Automation: Benefits, Best Practices, ROI](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/35p7kzzsy76ud/promo-image.1669136620.jpg)

[FREE] When to Consider Automation: Benefits, Best Practices, ROI

Join Verafin Product Expert Corey Lynch as he discusses best practices for developing a business case for automation – this important process can uncover the challenges faced by your institution, and highlight the many benefits offered by an automated financial crime management solution. (Rec. 5/21/22)

$99

1 Hour

On Demand

BSA/AML

Fraud

Strategic Business Review

Verafin

Intro to Crypto School - Parts 1&2

This 2-day school with cover Cryptocurrency essentials, CBDCs and Stablecoins, finding crypto in your FI, and common frauds and scams. (Rec. 5/3/22)

$399

4 Hours

On Demand

Risk

Basics

Blockchain

Cryptocurrency

Fraud

Stablecoins

School

CBDC

Understanding Terrorist Financing and Proliferation Financing

However, how do you monitor for terrorist financing, or can you even monitor at all? What is proliferation financing and how do you monitor for it? This session will help answer these questions so register today! (Rec. 1/12/23)

$179

1 Hour

On Demand

Compliance

FinCEN

Fraud

Terrorist Financing

Volcker Rule

2022 Updates: Recent amendments have changed the scope and coverage of the Vlocker rule. This webinar will go over the background of, and recent changes to, the Volcker Rule. (Rec. 5/24/22)

$179

1 Hour

On Demand

Regulation

Compliance

Updates

Advanced

investments

Vlocker Rule

Hedge Funds

YOU Get a Refund! And YOU Get a Refund! Tax Refunds and ACH

With a majority of tax refunds delivered via ACH each spring, financial institutions face the challenges associated with exception processing related to ACH tax refund payments. This session will help you ensure that your processing of ACH tax refunds is efficient and that it protects your financial institution from losses associated with incorrect handling of these types of payments. (Rec. 2/8/23))

$179

1.5 Hours

On Demand

Compliance

ACH

Tax Reporting

Training - RDFI Workshop: ACH as a Receiving Depository Financial Institution (RDFI) Operational Basics

Whether you are new to the position or serve as backup when coworkers go on vacation or are a veteran banker but need to know more about ACH processing, these sessions will give you an in-depth look at your obligations, rights and responsibilities as a Receiving Depository Financial Institution (RDFI).

$399

5 Hours

ACH

Payments

Basics

RDFI

Training

Demystifying the Reg E FAQs

This session will thoroughly explain the requirement to fully protect your consumers under Regulation E, including the recently released CFPB FAQs, to help you remain compliant. (Rec. 5/19/22)

$179

1.25 Hours

On Demand

Regulation

Payments

Reg E

Basics

Debit Cards

EFC

CFPB

Epay

Angelica Larranaga

CECL - Last Stop Before Compliance

Join Peter Cherpack, a thought leader on CECL compliance for community banks, as he presents the recipes for the CECL transition. (Rec. 3/2/22)

$179

1 Hour

On Demand

Regulation

Compliance

CECL

SCALE model

P2P Doesn't Have to Mean Faster Fraud

(Rec: 9/12/23) Don’t miss this chance to learn about the unique features of P2P transfers via the ACH network. This session will cover: ACH Rules for P2P entries, Unique ACH Format requirements, Risk Management, and Errors and unauthorized.

$179

1 Hour

Lending

Fraud

Consumer Protections

Live

Climate and Credit Risk - Tips for Smaller Banks

What types of climate-related credit risk should community banks and other smaller institutions be aware of? What can, and should, bankers at smaller banks be doing about climate risk in their portfolios? How can they prepare for future regulatory expectations? What information do they need to track? Join Peter Cherpack, EVP of Ardmore Banking Advisors, as he explores some common sense approaches to building awareness of climate-related credit risks in smaller bank portfolios today.(Rec. 2/9/23)

$179

1 Hour

On Demand

Regulation

Compliance

Risk

Credit

Risk Assessment

HMDA Rules 2022: 3-Part Series

Join us as Sterling Compliance hosts a 3-part series on the rules of HMDA, and take back to your FI, a detailed HMDA reference guide that includes procedures, a data collection checklist, and a demographic collection form, among other resources. (Rec. 6/28/2022)

$499

3 Hours

Regulation

Compliance

Basics

Real Estate

Mortgages

School

Advanced

Reporting

HMDA

Friday Compliance Briefing: December 2021

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. (Rec. 12/17/21)

$15

0.5 Hours

Compliance

Training - Payments Bootcamp Program

This training class is designed for new staff at Financial Institutions. New employees may be well trained in their day-to-day tasks, while lacking in basic understanding of the four main payment systems. These sessions are intended to give new operations staff a baseline understanding of ACH, Wire, Card, Checks, plus basic Teller Operations to include transaction flow for deposits and withdrawals, cash handling procedures, and preparing your station for customers.

$299

2 Hours

ACH

Payments

Basics

Wire Transfer

Cards

Debit

Operations

BSA Reporting Requirements Summer 2023

In this day and age, criminals understand many different ways to infiltrate a financial institution. We must understand how to identify when to report, how to report, and the contents to include. During this webinar we will tackle all 3 objectives and discuss what red flags to look out for. (Rec. 6/29/23)

$179

1 Hour

On Demand

Regulation

Compliance

BSA/AML

Fraud

BSA

Checking Out Check Adjustments

(Rec. 9/28/23)

$179

1.5 Hours

On Demand

Payments

Checks

Basics

Disputes

Climate POC Review

(Rec: 8/29/23) The impact of climate change on bank credit risk has become a topic of interest to regulators, audit firms, bank directors, and credit risk managers alike. Join Peter Cherpack, EVP of Ardmore Banking Advisors, and walk through an easy, common sense approach to starting your climate credit risk management process.

$179

1 Hour

Regulation

Risk

Live

Peter Cherpack

Climate Risk

Climate Change

Climate Credit Risk

Possible or Probable? How to Assess the Risk

The ACH Operating Rules require all participating DFIs, Third-Party Senders and Nested Third-Party Senders to conduct an assessment of the risks of their ACH activities. But how, is not specified. In this session, we will look at risk assessment best practices and how to maintain compliance with the requirements of your primary regulators. (Rec: 8/23/23)

$179

1 Hour

On Demand

Regulation

Compliance

Third-Party

Risk

ACH

Jessica Lelii

E-sign Act: December 2021

(Rec. 12/9/21)

$179

1 Hour

On Demand

Electronic

Signature

E-sign

Authorizations and Agreements

As the ACH network continues to grow, legal issues increase due to outdated, weak, or lack of agreements. (Rec. 12/8/21)

$179

1.5 Hours

On Demand

Authorization

Agreements

Credit Analysis Basics: 1 Day Virtual School

Attend this proactive webinar and learn how banks make lending decisions based on the five (5) C's of credit- capacity, capital, collateral, conditions, and character! The 4 hour virtual school will cover the basics of the three (3) main areas of bank lending - consumer, mortgage, and commercial lending. Each of the three areas will be illustrated with real life "case studies". The attendee will also be exposed to loan structure, loan support, and documentation issues and how they (Rec. 9/13/21)

$299

4 Hours

On Demand

Loans

Basics

Lending

Credit

RDC Rules and Regulations 2023

(Rec. 2/16/23) This detailed session covers everything: the rules governing image exchange; the FED, ECCHO, and Nacha agreements; laws governing check clearing; Regulations CC, J, and E; the Uniform Commercial Code 3 & 4; the role of legal agreements; and more!

$179

1 Hour

On Demand

Regulation

RDC

On demand

FREE Managing Fraud and Compliance Together with a Unified Approach

Are we still addressing fraud and compliance as two separate issues? With so many types of threats out there, it’s time to look at fighting financial crime and automating compliance holistically within one, unified solution. Find out how by joining this live webinar with Ravi Sandepudi, CEO, of Effectiv as he explores the challenges financial institutions face around fraud and risk. (Rec. 1/20/23)

FREE

1 Hour

Free

On Demand

Compliance

Risk

Vendor Management

AML Training on Red Flags: July 2022

Join Justin Muscolino, seasoned compliance training professional, as we discuss AML basics, red flags that may arise, reporting processes, escalation protocols, and more!

$179

1 Hour

On Demand

BSA/AML

Risk

Fraud

Red Flags

Advanced

AML

Regulation E In Depth Workshop 2021

This interactive session navigates through the depths of Regulation E and how it relates to the specific payments (e.g., ACH, Card, and Wire) rules to help ensure your financial institution’s compliance. Through the course of the day, real life examples are provided to demonstrate the regulation in action, bust some common Regulation E myths, and provide you with the foundation to apply what you have learned. Join us for this in-depth look at Regulation E. (Rec. 7/14/21)

$399

4 Hours

On Demand

Regulation

ACH

Payments

Reg E

Advanced

Error Resolution

Managing an AML Compliance Program

Required by law, all financial institutions must have an AML compliance program in place. During this webinar, we will discuss the 4 pillars of an effective program, reporting, onboarding and continuous monitoring. (Rec. 2/23/23)

$179

1 Hour

On Demand

Regulation

Compliance

BSA/AML

ABCs of RDC: Fall 2022

Learn the basics of Remote and Mobile Deposit Capture, mitigating risk, Regulation CC, and much more!

$249

1.5 Hours

On Demand

Risk

Payments

Checks

Basics

Online Banking

RDC

Regulation CC

Mobile Banking

Getting Ready for March Madness: The Elite 8 of Exception Handling

We don’t want payment exceptions to cause you to “foul out” of the game! We will discuss the most frequently asked questions regarding the check, card, and ACH exceptions to put you on the path to the championship. (Rec. 2/23/22)

$179

1.5 Hours

On Demand

ACH

Exceptions

Government

Handling

AML Training on Red Flags: February 2023

When it comes to AML, there are many different components. For staff, it is not only important to know how the rules impact their role, but to also understand the different types of red flags. In this webinar, we will discuss the background of AML, as well as the types of red flags you may encounter during your day-to-day activities. (Rec. 2/2/23)

$179

1 Hour

On Demand

Regulation

BSA/AML

Red Flags

Avoiding Risky Collisions at the Crypto & Bank Intersection 2022

This session will look at how and where cryptocurrency activity can be detected in traditional financial operations, and how the detection of those flows can give increased visibility into criminal actors, detect unregistered and illicit cryptocurrency businesses that may be using accounts at your bank, and understand how to appropriately conduct CDD/EDD on customers buying/selling cryptocurrencies. (Rec. 2/1/22)

$179

1 Hour

On Demand

Risk

Cryptocurrency

Advanced

2022 ACH Rules Update: January 2022

Join us January 26th to hear what's happening in 2022 and the steps your organization needs to take to be prepared. (Rec. 1/26/22)

$179

1.5 Hours

On Demand

ACH

Updates

Rules

2023 TRID 101: The Basics and Technical Nuances You Need to Know

Whether you’re new to mortgage lending or need a refresher, this session will provide critical foundational knowledge of the complex TILA-RESPA Integrated Disclosure Rule in plain English. You will learn not only the mechanics of the disclosures and how they vary for different types of transactions, when and why revisions may be necessary, but also how to avoid potentially costly violations. (Rec. 2/15/23)

$179

1.5 Hours

On Demand

Loans

Mortgages

TRID

Disclosures

Cryptocurrency: Balancing Risk with the Fear of Missing Out

Crypto is here to stay. Learn how to evaluate this emerging technology from a strategic risk management perspective. (Rec. 3/25/22)

FREE

1 Hour

Free

Regulation

Cryptocurrency

CBDC

Dealing with ACH Tax Refunds: Exceptions, Posting & Liabilities

This session is designed to ensure that your processing of ACH tax refunds is efficient and more importantly protects your financial institution from losses associated with incorrect handling of these types of payments. (Rec. 2/9/22)

$179

1.5 Hours

On Demand

ACH

Basics

Liabilities

Posting

Tax

Exceptions

AML Training on Red Flags February 2022

In this webinar, we will discuss the background of AML and also the types of red flags you may encounter during your day to day roles.Identifying red flags should be part of everyone’s education. (Rec. 2/10/22)

$179

1 Hour

On Demand

Red Flags

Advanced

AML

Training

Credit Update: Fall 2021 C&I and CRE Trends

AFS will present "Credit Update", an in-depth analysis of wholesale credit risk metrics. We will discuss how the rise of the delta variant has continued to put pressure on a number of industries. (Rec. 10/13/21)

$99

1 Hour

On Demand

Credit

CRE

Trends

Quarterly Winter 2022 Regulatory Compliance Update

Sterling Compliance teams up with CBANC every quarter to deliver affordable, to-the-day updates on what has happened and what to anticipate to keep you both current and proactive. (Rec. 2/9/22)

$99

1 Hour

On Demand

Compliance

Updates

Under $100

2023 Construction Lending and Real Credit Administration

Most bankers acknowledge that construction lending is riskier than other types of commercial lending. Repayment ability depends on successful completion of the construction before the project can generate cash flow, from rental or lease of the real estate, or from permanent take-out refinancing. Participants will learn how to evaluate the developer’s ability to repay the construction loan, develop an appropriate underwriting of the construction (Rec. 2/14/23)

$179

1 Hour

On Demand

Risk

Loans

underwriting

ACH Returns: 2 Day Vs. 60 Day

This session will focus on the ACH Network and how your FI should handle general Returns vs. Extended Returns.

$179

1.5 Hours

On Demand

ACH

Payments

Basics

Returns

Online Banking

8 P's of Credit

In this session, we will work with the QUESTIONS that need to be answered in order to book a loan that is both helpful to your borrower and profitable to your organization. We will do this by looking at the 8 Ps of every loan – including some that are purely internal. (Rec. 5/6/21)

$179

1.5 Hours

On Demand

Payments

Loans

Credit

CRB Coffee Break Third Quarter 2022

Each quarter, we will provide the CBANC Network with an update on the status of cannabis-related banking issues.

$99

1 Hour

On Demand

CCBP

Cannabis

Certified Cannabis Banking Professional (CCBP)

Marijuana Related Business

Compliance

Cannabis Related Business (CRB)

CRB Coffee Break

Stablecoins and DeFi

In this session, we will cover the basics of stablecoins and explain decentralized finance (DeFi).

$179

1 Hour

On Demand

Basics

Blockchain

Cryptocurrency

Decentralized Finance (DeFi)

Stablecoins

Fundamentals of CIP, CDD, EDD and CTR

During this webinar, we will go over the fundamentals of CIP, CDD, EDD, CTR, and current Issues that impact your day-to-day. (Rec. 4/13/23))

$179

1 Hour

On Demand

Compliance

Risk

CIP

AML

CDD

CTR

Intermediate

EDD

Flood Rules: Demystifying the Tricky Spots February 2022

We will make sure you understand the basics: mandatory purchase requirements, notices, and force placing coverage. (Rec. 2/3/22)

$99

1.5 Hours

On Demand

Advanced

Rules

Demystifying

Flood

Under $100

Lending Across the Business Cycle

Business cycles are inevitable, and bankers must understand borrowers’ funding needs through a cycle of four phases—early expansion, late expansion, early contraction, and late contraction—as well as how to identify and evaluate clients’ relative vulnerability to both economic and COVID recession. (Rec. 3/1/23)

$179

1 Hour

On Demand

Risk

Loans

Credit

BSA and OFAC

This webinar on BSA & OFAC, will not only focus on the pure fundamentals, but also on current events. (Rec. 8/4/21)

$179

1 Hour

On Demand

Advanced

BSA

OFAC

FREE: Working Together: A New Approach to Fighting Financial Crime

The need for collaboration and information sharing across the industry has never been clearer - but what do these ideas really mean and how can an institution effectively use them? Discover best practices and learn how your institution can use these tools to combat fraud and improve your AML processes. (Rec. 3/10/23)

FREE

1 Hour

Free

On Demand

Compliance

BSA/AML

Fraud

Verafin

Financial Crime

Government Payments Virtual School - One Day

Understand how the Green Book is your resource for all federal government payments. Why not gain insight into how federal government payment rules differ from ACH rules to provide peace of mind that you have all the right answers. (Rec. 4/29/21)

$599

6.5 Hours

On Demand

Payments

School

Government

Friday Compliance Briefing: September 2021

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. (Rec. 9/24/21)

$10

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

RO7 or RO8: Which One Should I Use?

One of the most common ACH audit findings is the incorrect use of return reason codes. Fear not - help is on the way! (Rec. 6/22/22)

$179

1 Hour

On Demand

Regulation

Audit

ACH

Payments

Advanced

RO7

RO8

Friday Compliance Briefing: July 2022

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease.

$15

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

Under $100

Friday Compliance Briefing: February 2022

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease.

$15

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

Exceptions Handling March 2023

Do you wish you were more exceptional at handling exceptions? During this session, we’ll discuss the most frequently asked questions regarding check, card, and ACH exceptions. (Rec. 3/29/23)

$179

1.5 Hours

On Demand

Regulation

ACH

Payments

Credit Cards

Cannabis Banking for the Board 2023

Whether you intend to bank Direct MRBs, or tailor your program to other segments of the cannabis industry, it is critical that your Board be informed and well-versed on cannabis banking concepts, as well as regulatory expectations. Join us for this one-hour webinar covering legalization, legislation, and expectations for your Cannabis Banking Program. (Rec. 3/7/23)

$179

1 Hour

On Demand

marijuana

Cannabis banking

![[FREE] Russian Invasion of Ukraine: What your FI Needs to Know](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/312ztrb8de080/promo-image.1668016475.jpg)

[FREE] Russian Invasion of Ukraine: What your FI Needs to Know

Everyone is aware that Russia invaded Ukraine and that OFAC has been issuing sanctions swiftly. Global banks must be aware of these sanctions along with what other countries are implementing against Russia. However, what do community banks and credit unions need to consider? (Rec. 3/4/22)

FREE

1 Hour

Free

On Demand

Advanced

Ukraine

FI

Friday Compliance Briefing: October 2021

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. (Rec. 10/29/21)

$15

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

![[FREE] Introduction to NFTs and DeFi](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/jjvi32pbz80s/promo-image.1681145832.jpg)

[FREE] Introduction to NFTs and DeFi

Register today to join this webinar FREE (Normally $249)! Events such as the WallStreetBets x GameStop x Robinhood ordeal are forcing more and more of us to consider alternatives to traditional financial (TradFi) systems—but it can be difficult to figure out where and how to get started. Join us while we cover the basics of DeFi, NFTs, and how they compare with TradFi. (Rec. 3/30/23)

FREE

1 Hour

On Demand

Investments

Cryptocurrency

Decentralized Finance (DeFi)

NFTs

ACH Fundamentals: Fall 2022

This course is designed to help get you started laying the groundwork and give you the building blocks to understand and utilize the ACH network.

$249

1.5 Hours

On Demand

NACHA

ACH

Payments

Basics

Online Banking

The Art of Setting ACH Exposure Limits

This session will explore the art, not science, of effectively setting limits for your ACH Originators.

$179

1.5 Hours

Compliance

ACH

Payments

Basics

ACH Rules Updates 2021

During this webinar, we will review recent changes to the ACH rules and also discuss upcoming changes that might impact your organization or specifically, your role. (Rec. 8/12/21)

$249

1 Hour

On Demand

ACH

Updates

Rules

Friday Compliance Briefing: January 2023

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. We will be offering a new Briefing once a month. (Rec. 1/27/23)

$15

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

FCB

AML/BSA Updates: September 2022

During this webinar, we will go through the basics of AML/BSA, updates that have occurred within the past years, discuss red flags and so much more.

$179

1 Hour

On Demand

Regulation

Compliance

BSA/AML

Updates

Red Flags

The 2023 Collaborative BSA School - CRCM Eligible

CBANC Network and AML-ology are partnering again this year to offer the 3-day 2023 Collaborative BSA School. Complete this training to earn 22 CRCM credits!

$999

Regulation

Compliance

BSA/AML

Fraud

Training

Cannabis Banking

MRB

E-Sign Act: January 2023

The E-Sign Act has been around for a period of years, but due to our evolving culture, amendments have been added to keep up with the technology. We will review the historical perspective and then look to the future and what it holds. (Rec. 3/9/23)

$179

1 Hour

On Demand

Compliance

Payments

E-Sign Act

Suspicious Activity

Everyone in your institution plays a role in reporting suspicious activity, so this session helps you determine what everyone’s role is in this process. The session also takes a deeper dive into what a suspicious activity report (SAR) is; what triggers a SAR; what activities may be considered suspicious; when a SAR should be filed; and, what happens after a SAR is filed. (Rec. 7/20/23)

$179

1 Hour

On Demand

Basics

Fraud

SAR

Reporting

Card Basics: Who, What, Where, When, Why

How do cards make your financial institution money? Why are there so many networks? Who is paying for the fees? This course will dive into the burning questions about cards and help you understand the card system and its participants. (Rec. 2/22/23)

$179

1.5 Hours

On Demand

Payments

Credit Cards

Multiple (2)

Protect Yourself: Handling Government Reclamations and Garnishments

The improper handling of Death Notification Entries (DNE), Government Reclamations, and Garnishments can expose financial institutions to potential significant dollar losses. This session will cover the proper procedures for handling ACH Government Reclamations and the garnishment of accounts receiving federal government ACH benefit payments.(Rec. 3/8/23)

$179

1.5 Hours

On Demand

ACH

Payments

Garnishments

Friday Compliance Briefing: February 2023

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. We will be offering a new Briefing once a month. (Rec. 1/27/23)

$15

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

FCB

Elder Financial Abuse Summer 2023

Any senior, regardless of economic status, gender, race, age, or educational background can be the target of financial abuse, so you need to be aware of the red flags. Do you have a plan in place to react effectively when this situation occurs? In this session, we will walk through scenarios that will provide resources to utilize as these situations arise. (Rec. 6/15/23)

$179

1 Hour

On Demand

Elder Abuse

Consumer Protections

Mid Year ACH Rules Update 2021

We are already halfway through 2021 and now is an excellent time to stop and double-check to make sure you are ready for upcoming ACH Rules changes in September 2021. (Rec. 6/23/21)

$99

1.5 Hours

On Demand

ACH

Updates

Rules

Remote Deposit Rules and Regulations

Remote Deposit Capture depends on legal agreements to compliantly operate within regulations and industry rules. (Rec. 4/14/21)

$179

1.5 Hours

On Demand

Regulations

Rules

Remote

Deposit

Friday Compliance Briefing: June 2021

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. (Rec. 6/25/21)

$15

0.5 Hour

On Demand

Compliance

Updates

Briefing

Quarterly Regulatory Compliance Update: Spring 2023

Compliance is already challenging enough without the constant effort to keep up with ever-changing regulation. Hit the ground running this year with industry expert Lisa Zigo from Sterling Compliance as she updates you on the latest news and changes that affect compliance for community banks and credit unions. (Rec. 3/22/23)

$99

1.5 Hours

Regulation

Updates

QCB

Elder Financial Exploitation Training

This presentation discusses the basics of who is susceptible to abuse, who the perpetrators are, red flags for customer-facing and operational professionals, and finishes with a case study of abuse that should have raised flags at firs

$179

1 Hour

On Demand

Culture

Financial Abuse

BSA

Elderly Abuse

Consumer Protections

RTP® Settlement, Prefunding and Reconciliation

Ready to learn more about how settlement, prefunding, and reconciliation work in the RTP Network? (Rec. 11/16/21)

$179

1 Hour

On Demand

Reconciliation

Settlement

Prefunding

January 2023 ACH Rules Update

Let’s get a jump on 2023! The ACH Network is constantly evolving and updating the Rules. Join us to hear what’s happening in 2023 and the steps your organization needs to take to be prepared. (Rec. 1/25/23)

$179

1.5 Hours

On Demand

Regulation

Compliance

ACH

Payments

Small Business Underwriting: Evaluation, Underwriting and Policy

Smaller loans have proven to be riskier—the probability of default increases as the size of the borrower decreases and the repayment term increases. The purpose of this webinar is to provide practical guidance on finding that balance and generating prudent profitability. (Rec. 9/16/21)

$179

1 Hour

On Demand

Loans

Credit

Small Business Services

Advanced Tax Return Analysis for the Banker: Fall 2022

This webinar will provide the banker with several advanced tax return concepts and related analyses to help them more effectively work with their business customers.

$249

1.5 Hours

Loans

Investments

Returns

Tax Reporting

Real Estate

Advanced

Bankers

Loan Documentation for CRE Lending Transactions

Attend this proactive seminar and receive a thorough overview of commercial real estate (CRE) loan documentation. (Rec. 8/24/21)

$179

1.5 Hours

On Demand

Lending

CRE

Consumer Lending

Loan

Training - ACH Fundamentals

An overview of ACH from the Payments Professor

$499

3 hr 45 min

ACH

ACH Training Payments Professor

Lifecycle of a Card Dispute: 2-Day School

This session will give an in-depth look into the card dispute process from start to finish, with several examples of transactions and scenarios plus a Q&A!

$399

4 Hours

On Demand

Payments

Debit Cards

Disputes

Fraud

Credit Cards

Card Management

School

Advanced

Reg E In Depth Workshop April 2023

This interactive workshop navigates through the depths of Regulation E and how it relates to the specific payments (e.g., ACH, Card, and Wire) rules to help ensure your financial institution’s compliance. Lessen the uncertainty and join us for this in-depth look at Regulation E (Rec. 4/25/23)

$179

4 Hours

On Demand

ACH

Payments

School

Intermediate

Wire Transfers

Regulation E

Lifecycle of Fiat to Crypto Payments

(Rec. 4/12/23)

$179

1 Hour

On Demand

Regulation

Payments

Fiat

Cryptocurrencies

External Funds Transfer

Year Ahead in Cannabis Banking

In this cannabis banking webinar, we will discuss 2022 Cannabis Industry Results, Cannabis industry predictions, and the SAFE Banking Act (what happened in 2022 and what we can expect in 2023) along with much more. (Rec. 1/26/23)

$179

1 Hour

On Demand

Cannabis

Marijuana Related Business

Banking Cannabis

Hemp

Banking the Cannabis Industry

Cannabis Related Business (CRB)

Fraud Across all Payment Systems Virtual School

Payments Fraud surged throughout the COVID-19 pandemic, both in traditional payments like check and ACH and in new faster payment systems that are becoming more widely adopted. (Rec. 8/2/21)

$399

4 Hours

On Demand

Fraud

School

Payment

Board of Director Compensation and Committee Best Practices

In this session, we will discuss director compensation trends. (Rec. 6/21/21)

$249

1 Hour

On Demand

Advanced

Compensation

Loan Committee

Practices

Evaluating, Underwriting, and Lending to Construction Contractors

(Rec. 4/19/23)

$179

1 Hour

On Demand

Lending

Construction

Underwriting

Destressing BSA April 2023

The Bank Secrecy Act has five pillars by which every institution must abide. Join Angelica Larrañaga, AAP, NCP, CAMS, as she demystifies and takes the anxiety out of BSA, AML, and CIP by explaining the five pillars of BSA; how AML and CIP fit in; and what all this means to your organization.(Rec. 4/20/23)

$179

1.5 Hours

On Demand

Compliance

BSA/AML

Basics

CIP

Opening Accounts for Non-Resident Aliens – BSA/OFAC Considerations

In this session, we will discuss the documents you should consider obtaining, the risks associated with various types of documents, and the risks non-resident aliens can pose to your institution. We will also consider ways to mitigate those risks, so your program is robust and meets regulatory expectations. (Rec. 7/19/22)

$179

1 Hour

On Demand

Regulation

Compliance

Risk

Culture

Advanced

Financial Abuse

Accounts

Immigration

Consumer Protections

2023 BSA/OFAC Considerations: Opening Accounts for Non-Residents

In this session, we will discuss the documents you should consider obtaining, the risks associated with various types of documents, and the risks non-residents can pose to your institution. We will also consider ways to mitigate those risks, so that your program is robust and meets regulatory expectations. (Rec. 4/20/23)

$179

1 Hour

On Demand

Compliance

BSA/AML

OFAC

Friday Compliance Briefing: May 2022

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease.

$10

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

Quarterly Summer 2021 Regulatory Compliance Update

Hit the ground running this summer with industry expert Lisa Zigo from Sterling Compliance as she updates you on the latest news and changes that affect compliance for community banks and credit unions. (Rec. 7/6/21)

$99

2 Hours

On Demand

Compliance

Updates

Regulatory

Training - Residential Mortgage Fundamentals Certification

This is part two of the Residential Mortgage Certifications offered by Cloes.Online.

$697

2022

Training

Residential Mortgage

Cloes

ERM Program Fundamentals for Success in the Banking Industry

This session outlines these and other foundational elements, allowing you to start or validate your ERM program.

FREE

1 Hour

Free

On Demand

Compliance

Risk

ERM

Banking

Basics of Banking Virtual School

This one day virtual school will provide an “introduction” to the banking industry and touch on most all aspects of banking. (Rec. 5/4/21)

$299

6 Hours

On Demand

Basics

School

Banking

Call Report Bootcamp 2021

(Rec. 9/2/21, 9/9/21, 9/16,21)

$599

6 Hours

On Demand

Call Reports

Bootcamp

Report

Training - Residential Mortgage Origination Practices Certification

Residential Mortgage Origination Practices Certification

$1,297

2022

Residential Mortgages

Training

Residential Mortgage

Cloes

The 5 Cs of Credit: Why Character Stands Out in 2023

Bankers have relied on the 5 C’s of credit—capacity, conditions, collateral, capital, and character for many years, but what do these terms really mean, and how do lenders use them to determine whether a potential borrower is creditworthy? This credit model is simple to understand and easy to use. Attend the session to C for yourselves! (Rec. 5/24/23)

$179

1 Hour

On Demand

Loans

Credit

Leadership: Dare to be Different Three Part Series

This Three Part Series presented by Dan Clark provides new insights into leadership. (Rec. 4/15/21, 4/16/21, 4/19/21)

$599

4.5 Hours

On Demand

Basics

Leadership

Series

Training - Universal Banking for Project Managers and Leadership

Universal Banking for Project Managers and Leadership

$999

5 hr 15 min

2022

Training

Extraco

Universal Banker

Project Management

Friday Compliance Briefing: October 2022

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease.

$10

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

The Recipe for Video Banking Success

Join Coconut Software as they walk you through building and executing a video banking strategy that’ll enhance the meeting experience and let your staff better serve your customers and members.

FREE

1 Hour

Free

On Demand

Basics

Online Banking

Coconut Software

FinTech

Banking

Seniors & Banking: Unlock the Value of Your Most Valuable Customers

Learn how engaging and protecting seniors today is the key to sustainable customer retention and acquisition in the future. (Rec. 7/12/22)

FREE

1 Hour

Free

On Demand

Culture

Financial Abuse

Elderly Abuse

Consumer Protections

Banking

Customers

Cannabis Banking Panel: Banking, Monitoring & Payments

With impending legalization at the Federal level, whether addressing cannabis as a substance or as a bankable commodity or both, it’s time to have a candid discussion about what that could mean. (Rec. 4/30/21)

$179

1 Hour

On Demand

Cannabis

Certified Cannabis Banking Professional (CCBP)

Payments

Banking

Monitoring

DFA 1071: Small Business Data Collection

The new, long-awaited rule was finalized on March 30th and brings many compliance challenges. This webinar will tell you what you need to know to understand the impact to your commercial lending team and key compliance concepts.(Rec. 5/16/23)

$179

1.5 Hours

On Demand

Compliance

Loans

Analytics

CRA

Small Business

Intermediate

Data Collection

Crypto Basics

(Rec. 5/27/23)

$179

1 Hour

On Demand

Basics

Cryptocurrency

DeFi

Bitcoin

Friday Compliance Briefing: May 2023

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. We will be offering a new Briefing once a month. (Rec. 5/19/23)

$15

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Updates

FCB

Lisa Zigo

Tax Return Analysis for the Consumer Lender

This seminar will assist the consumer lender in correctly analyzing the borrower's "personal cash flow" generated from their personal income, business income, and/or investment activities. (Rec. 8/3/21)

$99

1.5 Hours

On Demand

Analysis

Tax

Consumer Lending

Lender

Payments Bootcamp: Part 1 & 2

Join Jennifer Miller and Kim Ellis in this 2-part Bootcamp series for a crash course in payment basics!

$349

2 Hours

On Demand

Payments

Transactions

Checks

Basics

Payments,

Quarterly Regulatory Compliance Update Summer 2023

Compliance is already challenging enough without the constant effort to keep up with ever-changing regulation. Hit the ground running this year with industry expert Lisa Zigo from Sterling Compliance as she updates you on the latest news and changes that affect compliance for community banks and credit unions. (Rec. 6/28/23)

$99

1.5 Hours

On Demand

![[FREE] Ransomware Fundamentals: 10-D Security Half-Day Training](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/v3znqfkuevh4/promo-image.1689783112.jpg)

[FREE] Ransomware Fundamentals: 10-D Security Half-Day Training

The use of ransomware with breaches continues to rise year after year. The ideal ransomware response is preventative; avoid the attack in the first place. In this class you will learn how to plan for, prevent, and respond to ransomware attacks on your business. (Rec. 6/9/23)

FREE

4 Hours

10D, On Demand, Ransomware

Quarterly Regulatory Compliance Update: Winter 2023

(Live: 12/13/23) Compliance is already challenging enough without the constant effort to keep up with ever-changing regulation. Hit the ground running this year with industry expert Lisa Zigo from Sterling Compliance as she updates you on the latest news and changes that affect compliance for community banks and credit unions.

$99

1.5 Hours

On Demand

Regulation

Compliance

Briefing

Lisa Zigo

How to Evaluate a Borrower’s Ability to Survive Inflation and Recession

(REC: 9/19/23) This session offers some tips on evaluating survivability—what level of sales will generate a profit, how fast can revenues grow without having to borrow, how to reduce costs—that both lenders and owners can consider in setting their own strategies for fighting inflation and preparing for recession.

$179

1 Hour

Risk

Loans

Credit

Live

Recession

Inflation

After the Pandemic: Risk Management Basics Boot Camp

If you have ever wanted to learn about some of the important but not popular risks then this is the boot camp for you. (Rec. 8/11/21)

$499

4 Hours

On Demand

Risk

Basics

Management

Pandemic

Covid-19

CRA Basics: Parts 1&2

This two-part school will start with a refresh on the basic requirements of the CRA, and walk through how to perform a CRA Assessment, then move to a discussion on the qualifications for community development, and how to recognize and document community development activities.(Rec. 5/17/22)

$299

2 Hours

On Demand

Compliance

Procedures

Basics

Real Estate

Lending

School

Consumer Protections

CRA

Housing

Small Business

Proper Handling of IATs

Proper handling of IATs can save your financial institution time and money along with minimizing your risk. This session will give you step-by-step procedures on how to handle your IAT entries, focusing on suspect and return entries. (Rec. 6/8/2022))

$179

1.5 Hours

On Demand

Compliance

ACH

Procedures

Advanced

International Banking

IAT

All Things Loan Servicing

During this session we will not only discuss the mortgage servicing rules, but refresh on various other regulatory requirements that impact Loan Servicing.

$179

1.5 Hours

On Demand

Payments

Loans

Basics

Insurance

Lending,

Mortgages

Escrow Accounts

Friday Compliance Briefing: October 2023

(Rec: 10/27/23) If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease. We will be offering a new Briefing once a month.

$15

30 Min

On Demand

Regulation

Compliance

BSA/AML

Audit

FCB

HMDA Rules: 3-Part Series

We will make sure you understand the basics; covering the when, what, how and why to report HMDA Data. (Rec. 11/2/21-11/4/21)

$399

1 Hour

On Demand

Basics

School

Advanced

HDMA

![[FREE] Cyber and the C-Suite: What Top Management Needs to Know](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/blwdrq5u1l9b/promo-image.1668533595.jpg)

[FREE] Cyber and the C-Suite: What Top Management Needs to Know

This program will explain the responsibilities of executives and board members when it comes to cybersecurity and disaster recovery resiliency. (Rec. 11/17/21)

FREE

1 Hour

Free

On Demand

C-Suite

Cybersecurity

The Summer 2022 Collaborative BSA School: Day 1- Basics

Day 1: This session is designed for new BSA personnel or those wanting a refresher on the basics. We will cover an overview of the BSA, what drives your program, and what to include in your program.

$399

6 Hours

On Demand

Regulation

Compliance

BSA/AML

Basics

School

BSA

SAR

314(b)

OFAC

314(a)

CIP

![[FREE] Is your Bank Overpaying for Underperformance? Evaluating Your IT Department](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/3mt6bn72b05em/promo-image.1693523215.jpeg)

[FREE] Is your Bank Overpaying for Underperformance? Evaluating Your IT Department

(Rec: 9/29/23) Imagine the potential for growth and success if you understood how to leverage the power of technology to drive employee efficiency and customer satisfaction, without overpaying. Register for our webinar to understand why partnering with your IT department is not just important – it's essential.

FREE

1 Hour

Free

On Demand

Information Technologies

Management

Sponsored

Business

IT

Integris

Easy CECL? The Fed SCALE Tool

This webinar explores the new CECL estimation solution for small banks called the SCALE tool, its plusses and minuses, and the operational steps for a bank to use it. This early look should help smaller community banks to better understand if they should incorporate SCALE into their CECL transition plan. (Rec. 9/1/21)

$179

1 Hour

On Demand

Regulation

Credit

CECL

All Things Check: 1-Day Virtual School

Don't underestimate check payments and accompanying processes. Check transactions impact a significant part of the industry, and you can get up-to-date by attending this virtual school! (Rec. 11/10/21)

$399

4 Hours

On Demand

Regulation

Payments

Checks

Basics

RDC

![[FREE] Payments Fraud: Charting a Growing Threat](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/3v3qhjjfqwz0j/promo-image.1668997311.jpg)

[FREE] Payments Fraud: Charting a Growing Threat

Join industry expert and Verafin Product Manager Maurecio Castanheiro for this insightful session as he discusses the many payments fraud trends and challenges facing financial institutions, including wire and ACH fraud scenarios, and how leveraging consortium data and cross-channel analysis in a cloud environment can help institutions take decisive action. (Rec. 7/30/21)

$99

1 Hour

On Demand

ACH

Payments

Fraud

Wire Transfer

Fintech

Monitoring

Payments,

Why EBITDA Doesn’t Spell Cash Flow - But What Does?

EBITDA is a popular measure of cash flow, but it is not accurate! Bankers and investors who rely on it as an indicator of repayment ability will be deeply disappointed. This one hour session includes several examples and a case study to illustrate why EBITDA is flawed and how to apply better cash flow tools that actually measure repayment ability from cash flow. (Rec. 12/14/21)

$179

1 Hour

On Demand

Payments

Credit

EBITDA

Deceased Account Holders

Not correctly responding to DNEs and Treasury ACH Reclamations can expose financial institutions to potential significant dollar losses. This 90 minute webinar on July 28, will cover the proper procedures for handling ACH Treasury Reclamations and federal government ACH benefits received by deceased account holders. (Rec. 7/28/21)

$179

1.5 Hours

On Demand

Compliance

ACH

Procedures

Accounts

Consumer Protections

Basics of Crypto Virtual School: Parts 1&2

This session is designed to provide a foundation for those new to cryptocurrency and blockchain. (Rec. 10/6/21 & 10/14/21)

$399

2 Hours

On Demand

Basics

Cryptocurrency

School

Cryptocurrency 101

This session will cover common cryptocurrency terms, types of digital currencies, regulations, and other areas to consider when looking to enter into this space. (Rec. 3/17/22)

$179

1.25 Hours

On Demand

Regulation

Basics

Cryptocurrency

Compliance in Commercial Lending 2021

Internal classification of a loan as "commercial" doesn’t necessarily mean it is exempt from the disclosure or reporting requirements typically associated with consumer lending. It is critical for commercial lending staff to know what regulations apply to commercial loans and where some of the consumer-focused regulations intersect for certain transactions. On July 22, we will give you the low-down on the regulations you need to be aware of! (Rec. 7/22/21)

$179

1 Hour

On Demand

Regulation

Compliance

Loans

Commercial Lending

HMDA

Reg B

FCRA

Fair Credit Reporting Act

Card Fraud - Christmas in July Card Fraud Never Dies

Even Santa can experience identity theft. Now’s the time to make sure you are up to speed on current card fraud trends before the holiday shopping season is in full swing! (Rec. 7/13/22)

$249

1.5 Hours

On Demand

Payments

Basics

Debit Cards

Fraud

Consumer Protections

Identity Theft

Stablecoins: Current and Future Utility for Banks

This session covers the trends and outlines the differences between the three monies, with a particular focus on how banks are already using stablecoins. (Rec. 12/15/21)

$179

1 Hour

On Demand

Cryptocurrency

Decentralized Finance (DeFi)

Stablecoins

Tone at the Top: Culture's Role in Risk for FIs

This webinar will review enforcement actions that refer to culture, identify the behaviors that create and control risk, and talk about how to maintain a strong positive culture so you can develop a strategy to avoid reputation risks that can result in financial losses and position your FI for long-term success.

FREE

1 Hour

Free

On Demand

Risk

Culture

Professional Skills

Crypto Basics: Everything you Need to Know About Crypto

This seminar will introduce the nuts and bolts of blockchain and cryptocurrencies.

$249

1 Hour

On Demand

Basics

Blockchain

FATF

Cryptocurrency

FinCEN

Loan Committee Presentation Skill Training

Attend this webinar and learn skill-building techniques that include the “do’s & don’ts” of loan committees, exploring “group dynamics,” and tips on how to actually make a clear, concise, and motivating presentation.

$99

1 Hour

On Demand

Loans

Professional Skills

Presentation Training

Skill Training

Loan Committee

CRB Coffee Break: Fourth Quarter 2021

From marijuana legalization initiatives, marijuana-related banking issues, cannabis banking opportunities, and how financial institutions are addressing these issues, this will be your one-stop shop to stay up to date on the latest developments.(Rec. 11/19/21 )

$99

1 Hour

On Demand

Cannabis

Regulation

Certified Cannabis Banking Professional (CCBP)

Marijuana Related Business

Compliance

Cannabis Related Business (CRB)

CRB Coffee Break

Quarterly Summer 2022 Regulatory Compliance Update

Hit the ground running this summer with industry expert Lisa Zigo from Sterling Compliance as she updates you on the latest news and changes that affect compliance for community banks and credit unions.

$99

1.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Updates

BSA

Friday Compliance Briefing: January 2022

If you're looking for an easy way to stay up to speed on compliance and BSA issues without having to weed through all the emails and alerts you receive every day, our Friday Briefings are your ticket to compliance ease.

$10

0.5 Hours

On Demand

Regulation

Compliance

BSA/AML

Audit

You’d Better Check Yourself: Check Returns & Adjustments

Even with today’s electronic processing of checks, errors still occur. Learn the proper steps, codes, and timeframes for the timely and accurate processing of check adjustments.

$179

1.5 Hours

Compliance

Risk

Checks

Basics

Online Banking

Practical Advice on Ethics for the Financial Industry

In this presentation, we will start with a historical framework for ethics up to the present day. Then, we will explore ethics in the news and the world around us. (Rec. 7/19/22)

$99

1 Hour

On Demand

Audit

Basics

Fraud

Ethics

Consumer Protections

How to Craft an Effective Commercial Loan Write-Up/Committee School

The first part of this webinar will cover the basics of how to craft an effective commercial loan write-up. The second part of the webinar will review loan committee presentation “skill building techniques” that include the “do’s & don’ts” of loan committee, “reading” the personalities of the committee members, understanding the difference between an “outside” versus “inside” committee member, and exploring “group dynamics.” (Rec. 10/4/21)

$599

6 Hours

On Demand

Loans

Credit

Loan Committee

A Risk-based Approach to Sanctions Compliance

Join industry expert and Verafin Product Evangelist Corey Lynch for this insightful session as he discusses why maintaining an effective sanctions screening program can protect your institution from compliance risk and limit the funding of nefarious and illicit activity. (Rec. 6/13/22))

FREE

1 Hour

Free

Compliance

Risk

Advanced

SAR

Reporting

Sanctions

on demnad

Audit and Risk for ODFI

This session will focus on the Nacha Operating Rules, audit requirements, and guidelines specific to ODFIs.

$179

1.5 Hours

On Demand

Regulation

Audit

Risk

ACH

ODFI

![[FREE] Doing Great by Doing Good: Boost Deposits and Revenue Through Your Community Impact Programs](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/10yavx19r6tb/promo-image.1692303660.png)

[FREE] Doing Great by Doing Good: Boost Deposits and Revenue Through Your Community Impact Programs

(Rec: 9/14/23) Join us for an exclusive webinar that's all about turning banking into a force for good and boosting engagement and revenue along the way. Spiral will reveal the secrets of new products and services that are driving positive change and growth for financial institutions.

FREE

1 Hour

Free

Vendor Management

Banking

Community Banking

Live

CFPB's Debt Collections Rules

The CFPB's debt collection rules will have a major impact on how and when consumers are contacted to pay off debt, and the consequences of non-compliance can be severe. This webinar will discuss business and consumer rights under the new rules. (Rec. 5/10/22)

$179

1 Hour

On Demand

ACH

Payments

Basics

Returns

Processes

The Green Book

CFPB

Collections

Call Report Update 2022

With Call Reports receiving more regulatory scrutiny than ever, it is imperative that Call Report preparers and reviewers stay current with revisions to the reporting forms and instructions. A team of experts from Mauldin & Jenkins, LLC will update you on all recent changes and provide insights to help your call reporting process.(Rec. 4/12/22)

$179

1.5 Hours

On Demand

Regulation

Updates

Call Reports

2022 Fair Lending Risk: Turning up the Heat on Enforcement

This session will evaluate handling of COVID accommodations to your existing customers, PPP applications, turnaround time on mortgage applications, loan servicing and other aspects of lending operations that could be creating disparities that disadvantage minorities.

$179

1.5 Hours

On Demand

Loans

Mortgages

Fair Lending

Consumer Lending

Credit Update: Summer 2021 C&I and CRE Trends

AFS presents "Credit Update", an in-depth analysis of wholesale credit risk metrics. We will discuss recent industry volatility, loan performance and how fiscal stimulus and bank deferral/modification programs have affected bank loan growth and credit quality. This data is sourced from the AFS/RMA Risk Analysis Service, the industry's only comprehensive standard for credit risk benchmarking. (Rec. 7/12/21)

$99

1 Hour

On Demand

Risk

Real Estate

Credit

CRE

Financial Analysis

Common Audit Findings

In this presentation, we will explore the underlying and systemic issues that can cause problems at any company, and provide practical advice to resolve these issues for good!

$179

1 Hour

On Demand

Compliance

Audit

Basics

Accounting Basics: Refresher for Bankers 2022

This webinar will provide the banker with the "basics/refresher" of accounting. The training session will demonstrate how the income statement, statement of owner's equity, balance sheet, and statement of cash flows are developed and connected to each other.(Rec. 4/19/22)

$179

1 Hour

On Demand

Risk

Loans

Basics

Lending

Advanced

Accounting

CPA

Bankers

Construction Lending and Real Credit Administration

Repayment ability depends on successful completion of the construction before the project can generate cash flow from the sale of the finished property, from rental or lease of the real estate, or from permanent take-out refinancing During the construction period, the collateral is literally work-in-progress and often the guarantors do not have sufficient outside net worth or income to pay off the loan. Participants will learn how to evaluate the developer’s ability to repay the co(Rec. 7/19/23)

$179

1 Hour

On Demand

Loans

Lending

Credit

Construction Lending

Construction

The Spring 2022 Collaborative BSA School Bundle

CBANC Network and AML-ology are partnering again this year to offer the 2022 Collaborative BSA School. Refresh your BSA basics and learn tools for setting up your own BSA program, then prepare for a 2-day deep-dive into AML, Identity theft, fintech, money laundering, and much much more!

$999

2 Webinars

Cannabis

Regulation

Compliance

BSA/AML

Basics

FinCEN

Culture

School

Advanced

Financial Abuse

BSA

SAR

314(b)

OFAC

314(a)

CIP

Money Laundering

Elder Abuse

AML

![[FREE] Unlocking the Power of Knowledge Management for your FI](https://cc.sj-cdn.net/instructor/snvastni6uso-cbanc-network-inc/courses/1ni0x6vqlxqe6/promo-image.1669069122.jpg)

[FREE] Unlocking the Power of Knowledge Management for your FI

A winning customer experience begins with a solid foundation for employee success: learning, training development, and an undisputable understanding of where to go for consistent, up-to-date, and accurate information. (Rec. 6/11/21)

FREE

1 Hour

Free

On Demand

Management

Knowledge

Reg E In Depth Workshop March 2022

Through the course of the workshop, real life examples are provided to demonstrate the regulation in action, bust some common Regulation E myths, and provide you with the foundation to apply what you have learned. Lessen the uncertainty and join us for this in-depth look at Regulation E. (Rec. 3/16/22)

$399

4 Hours

On Demand

Regulation

ACH

Payments

Reg E

Debit Cards

Credit

Wire Transfer

Credit Cards

School

Advanced

Card Payments

Construction Lending and Real Credit Administration